Solve Money

Chief Design Officer

A serial founder set out to transform how small businesses in Nigeria accept payments and access credit. The core insight: most rely on cash because existing payment systems are too complex.

This initiative wasn’t just about transactions—it was about inclusion. By integrating small businesses into the financial system, they could access essential services and growth opportunities, and long-term financial sustainability.

With the potential to scale across Africa, the vision was aimed to build a pan-African digital financial ecosystem, driving economic development and improving millions of lives.

Solving the Challenge (Pun Intended)

To turn an idea into a market-changing reality, I needed to validate the hypothesis, refine the concept, and build a product that truly met the needs of small businesses in Nigeria. So, I packed my bags, built a prototype, and headed to Nigeria.

Validating the Assumption

Through market research, rapid prototyping, and field research, I aimed to confirm that digital payments were too cumbersome for small businesses. Key findings included:

Market Research: Small businesses relied on cash due to unreliable digital payment systems.

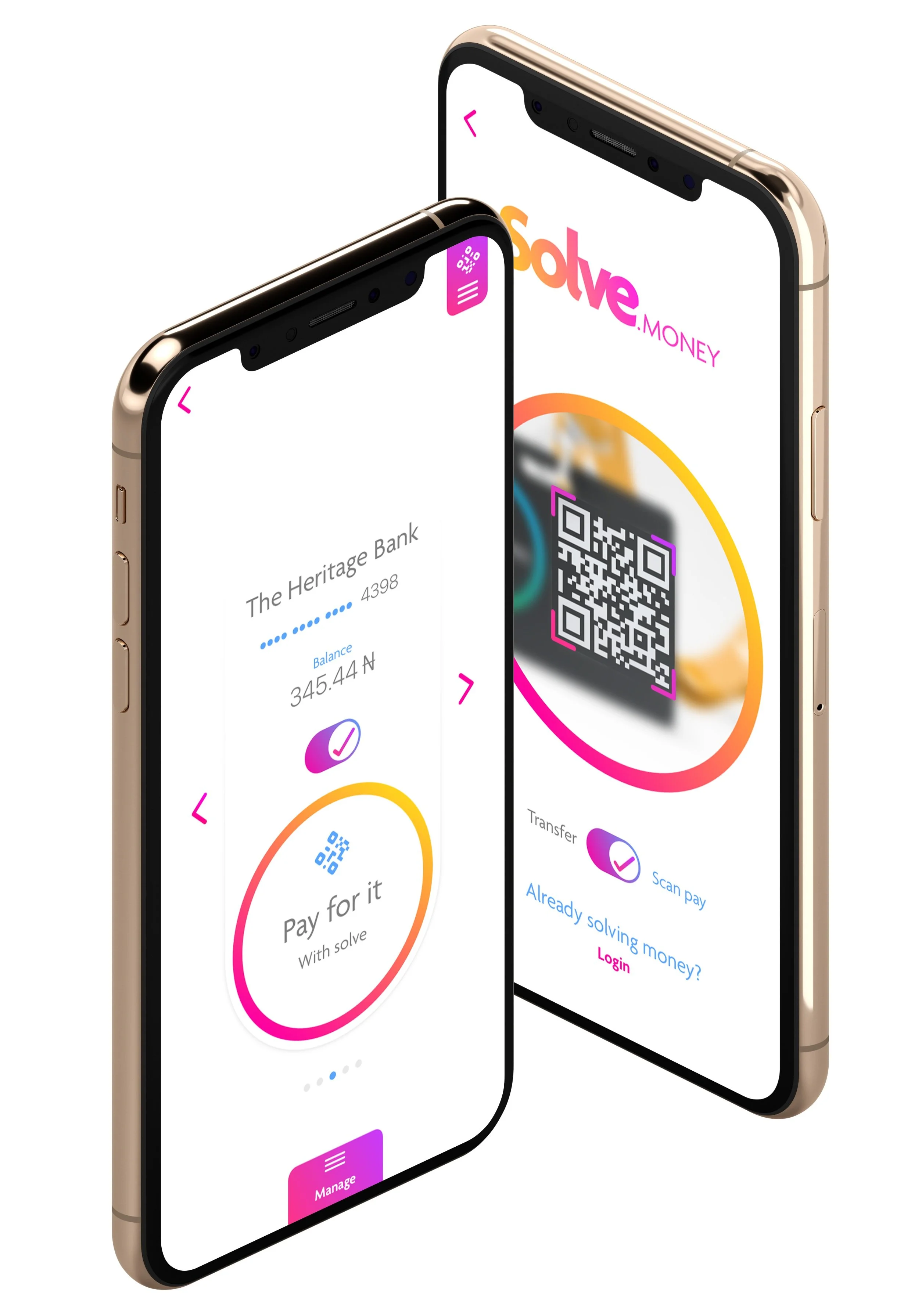

Rapid Prototyping: A user-friendly prototype was developed to address these pain points.

Field Research: Spending a week in Nigeria, I conducted interviews, observed operations, and tested the prototype, which could send and receive real money.

A Surprising Discovery

Our assumption was wrong. Digital payments were already in use, though flawed. The real pain point? Access to working capital. Small businesses needed funding to manage cash flow and grow.

Pivoting to Revenue-Based Lending

To capitalize on this insight, I shifted focus from payments to an integrated solution that combined digital transactions with working capital loans.

Prototype Redesign: The platform was restructured to assess creditworthiness based on transaction data and streamline loan access.

User-Centric Design: Loans were seamlessly integrated into the payment feature, with educational resources for support.

Field Testing: The revised product was tested with diverse businesses across Lagos—retailers, service providers, and wholesalers—to assess product-market fit and refine features.

Delivering Lasting Impact

With insights validated, I developed an investor pitch and business model that highlighted:

Unique Value Proposition: A financial model emphasizing scalability and impact.

Compelling Pitch: A refined product proposition backed by real-world research.

Successful Fundraising: The investment secured enabled Solve to accelerate development, expand the team, and activate marketing.

What’s Next?

With funding in place, Solve is focused on:

Launching the product with a robust, user-friendly experience.

Expanding the team in Nigeria.

Building awareness through targeted marketing.