Role Design Strategy Director

Client Manchester City Football Club

Service Design.

How might we build new create a self-funding internal capabilities that will delight the customers?

A self-funding CX program.

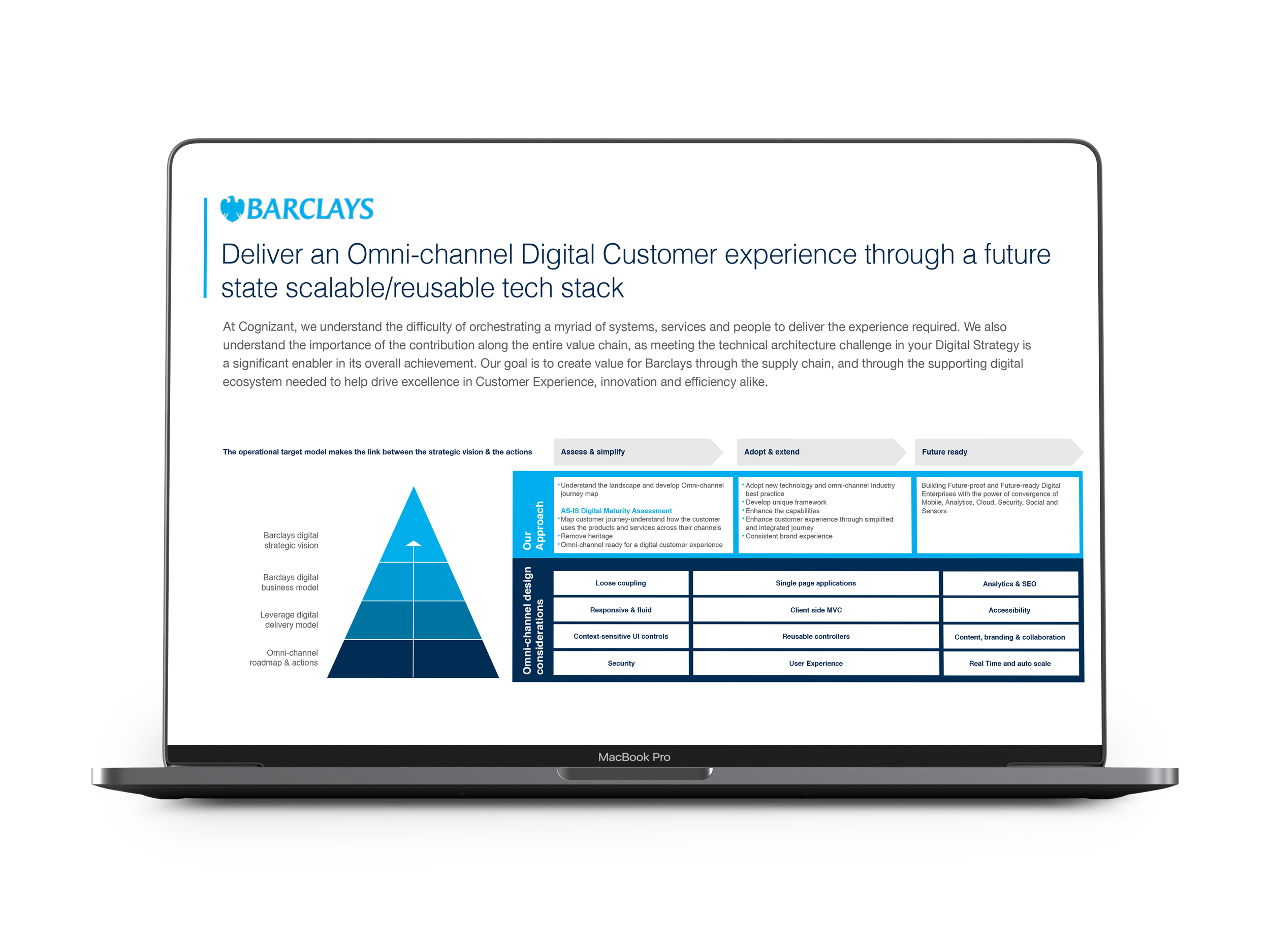

Barclays Corporate had an urgent need to digitally transform their operations to better meet customer expectations and improve overall customer experience (CX). The key specific asks:

✨How can we enhance our customer experience?

✨How do we build new internal capabilities?

✨How might we gain management trust and support?

✨How can we develop a transformation roadmap?

✨How can we deliver value immediately?

Our key assumption was if we could deliver measurable quick-wins, we could demonstrate value and build the internal capability. This, in turn, would build trust and support, paving the way for a comprehensive, self-funded digital transformation.

💡The challenge in the ask

Barclays Corporate lacked internal resources to effectively drive their own transformation. This included skills in technology, customer experience design, and change management. There was also a lack of trust from senior management in committing to a full-scale digital transformation. Previous initiatives had come up short, leading to skepticism about the feasibility of such a transformation. Overcoming this barrier was our real challenge as it would unlock support and resources.

💡Answering the challenge

I started by engaging key stakeholders across the organisation to understand their concerns, expectations, and establish a vision for the transformation. This helped build a shared vision and alignment around project goals. Collaborative design workshops and interviews were conducted to gather insights, discover quick wins, and foster a sense of ownership among stakeholders.

To build traction and internal credibility, we prioritised the quick-win CX initiatives based on their potential to deliver immediate tangible benefits. Building on these quick-win foundations, we sketched a roadmap that enabled us to link each initiative to its business outcome, ensuring that each project contributed to the overall strategic goals. Key components of the roadmap included:

Outcomes maps Establishing clear connections between CX initiatives and business metrics.

Funding routes Ensuring initial initiatives generated enough ROI to fund subsequent initiatives.

Measurement Setting up structures and performance measurement to ensure accountability.

Knowledge transfer and mentoring were key elements to ensure that the organization could sustain and scale the transformation efforts independently. We also established cross-functional squads to work on each of the quick-win initiatives. Each squad consisted of a designer, developer, data analysts, and a member of the Barclays team acting as a subject matter expert. Each pod operated with a clear mandate:

Metrics Define clear key performance indicators for both the customer and the business.

Data Use analytics to continuously monitor performance and make data-driven decisions.

Broadcast Report progress and highlight tangible benefits and how they contribute to goals.

Business cases Develop lean business cases to justify further investments .

As we implemented each initiative and demonstrated its ROI, they would evolve into larger, more comprehensive efforts. This approach ensured a sustainable cycle of continuous innovation, driving long-term business growth.

The lean roadmap, initially developed to link quick-win to specific outcomes, evolved into a comprehensive service design blueprint as each initiative matured. This blueprint detailed the end-to-end processes that was needed an enhanced customer experience, mapping out the journey, as front-stage actions, backstage processes, and support systems and data. To ensure the entire business rallied behind the transformation, the blueprint was printed as a large, and displayed in the office. This served as a constant, tangible reminder of the journey the business was on, fostering alignment, transparency, and collective ownership.

💡The impact

The digital transformation journey at Barclays was a strategic and well-executed initiative that not only met but exceeded expectations, delivering sustainable business value and fostering a culture of continuous improvement. By adopting a quick win approach to buid credibility and demonstrated clear ROI, we were able to secure trust and further funding.

💡My learnings

If you’re passionate about unlocking creativity in everyone, projects like this are great fun. But banking introduces its own set of unique challenges, commercial bankers excel at minimising risk through analytical thinking. And yes their deductive reasoning is super awesome in banking, but also leads to discomfort when faced with ambiguity! When faced with, phrases like "I don’t know yet" they get uneasy quickly. This project taught me that if you address this mindset clash head-on, you can create an environment where both creativity and analytical thinking thrive. The key to this was integrating data and metrics into the creative process earlier, providing a safe place to start form allows more analytical minds to embrace creativity.

⚡️Outputs

• Transformation strategy

• Product roadmap

• Business cases

• Business cases

⚡️Methods

• Agile research

• Lean product design

• User-centered design

• Process mapping